LLP Registration in Kolkata

Starting @ ₹7499/-

- DSC for 2 Directors

- DIN for 2 Directors

- Partnership Deed

- Company PAN

- Company TAN

- Certificate of Incorporation

Make an enquiry

LLP Registration in Kolkata Process

LLP Registration in Kolkata is very easy with the professional management of SLPL. A limited liability Partnership or LLP is another company business type that offers the advantages of limited liability to the partners at low compliance prices. It additionally permits the partners to arrange their internal structure sort of a traditional partnership. A limited liability partnership may be a legal entity, accountable for the total extent of its assets. The liability of the partners, however, is limited. Hence, LLP may be a hybrid between an organization and a partnership means to say that it incorporates the benefits of both partnership company into a single form of organization.

Minimum Requirement for LLP Registration in Kolkata

- Minimum 2 Partners.

- No minimum Capital requirement for to register LLP

Documents Required for LLP Registration in Kolkata

- PAN Card copy of each Partner

- Residence Address Proof of each Partner (any one)

a) Aadhaar Card

b) Election Card

c) Driving License

d) Passport Copy

e) Bank Statement (up to two months old)

f) Bank Passbook with last two months entries

g) Latest Electricity Bill

h) Mobile Bill (postpaid)

i) Landline Bill (postpaid) - 1 Colour Photograph of each Partners

- Place of Business Proof in India (any one)

Electricity Bill

Mobile Bill

Landline Bill

Gas Bill

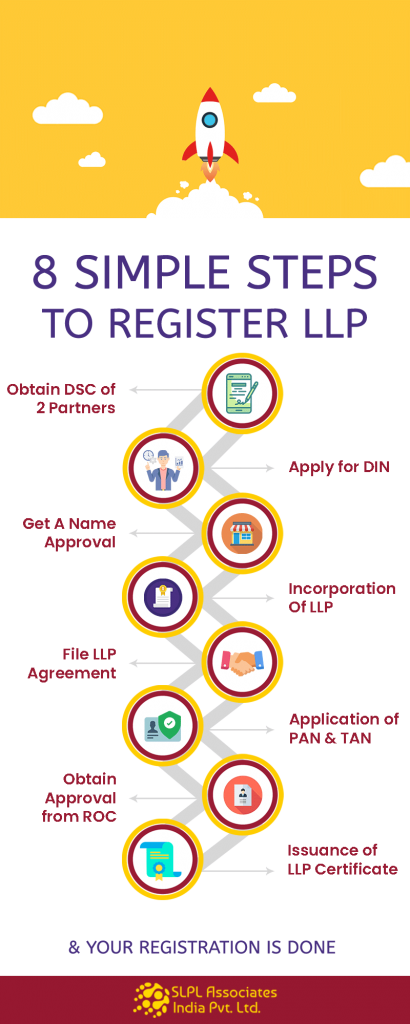

Steps involved involved for LLP Registration in Kolkata

Step 1: DSC (Digital Signature) of two partners

Step 2 : DIN (Directors Identification Number) of two partners

Step 3 : LLP Name Approval from ROC

Step 4 : Certificate of Incorporation is generated by Submitting Final Documentation (like Subscription Page, Business Address Proofs, etc.)

Step 5 : LLP Agreement will be prepared and submited to ROC

Step 6 : Application for PAN & TAN

Timeline for LLP Registration in Kolkata

It takes 12 to 15 working days (approx.) to complete Limited Liability Partnership Registration procedure. Timeline may vary depending on replies from ROC department.

What you will get by LLP Registration in Kolkata through SLPL Associates ?

- DSC (Digital Signature) of two partners

- DIN (Directors Identification Number) of two partners

- LLP Name Application

- Drafting and Preparation of LLP Agreement

- Reply to queries raised by ROC department

- Government Fees

- Payment of Stamp Duty and

- Registration Fees

- Our Professional Fees

- Certificate of Incorporation

- PAN Application of LLP

- TAN Application of LLP (TAN – Tax Deduction Account Number)

- Support to Open a Bank Account

- ISO certified Team of SLPL Associates Pvt Ltd

- Tax Consultation for Free

Why Limited Liability Partnership (LLP) is better than Partnership Firms in India ?

Partnership firms in India are governed by the partnership act 1932, where two or more persons have agreed to carrying out business with an objective to share profit by an agreement of mutual consent on the terms of agreement, where the business is carried on by all or any one of them carried acting for all.

Persons who have entered into one another are called individuals, ‘partners’ and collectively ‘a firm’ and the name under which their business is carried on is called the ‘firm name’

The partnership firm has no separate legal entity, so according to Indian partnership Act 1932 partners of the firm has joint and several liabilities to the firm.

An alternative form of organisation where two or more persons are involved in starting the business organisation is the ’Limited Liability Partnership’ or LLP. Under Limited Liability Partnership act 2008.

In an LLP form the liability of a partner is limited to the extent of his contribution towards LLP, except in case of intentional fraud. LLP has a separate legal entity unlike partnership firms incorporated under partnership act 1932.

ADVANTAGES OF LLP OVER PARTNERSHIP FIRMS:

- A major advantage of LLP Firm is that the liabilities of the LLP lies with the entity and does not fall on the individual partners unlike general partnership firms. This is one of the major reasons for its popularity. It has the separate legal entity.

- The liability of partners is limited to their contribution towards LLP, where as in partnership firms the liability of the designated partners can also reach to their personal properties and belongings. Limited risk of the partners signifies the name of LLP.

- Minimum 2 designated partners are required to incorporate both partnership firms and LLP, but a major advantage of LLP is that there is no upper ceiling for partners. LLP can take as much partners it like to take. But in Partnership firms the upper ceiling of partners is 50. It cannot take more than 50 partners.

- Registration of LLP can be done online and it can be registered on MCA portal, where as there is no facility available for partnership firms to be registered online. Online registration is mandatory for the LLP.

- The name of the LLP is unique and its could not be matched with others firm name, but the partnership firm has no unique name guarantee for its incorporation. So LLP has higher credibility in terms of credit availability and investment as compared to partnership firms.

- For its online registration at MCA portal, each important data like financial document and LLP agreement is available in public domain, but for the partnership firms this facility is not available.

- Perpetual succession is another important advantage of LLP over partnership firms, as it can exist even after change in the partners. Whereas the partnership firms may dissolve after the death or removal of its partners, as per the clauses mentioned in partnership deed.

Know more about Limited Liability Partnership Company Registration.

Frequently Asked Question ?

To register Private Limited Company in Kolkata , the following criteria to be mentained:

- Minimum 2 directors are required, one must be Indian.

- Minimum 2 shareholders are required, in pvt ltd company one can become shareholder and diretor at the same time.

- Office Address must be provided to register a company in kolkata India.

To register a pvt limited company, one must provide at least 1 lakh INR as an authorized capital.

To register a unique name one must provide at least two unique names for the company to the registrar. The applicant must follow the rules and regulations of reserving names for their company. Registrar may ask you to again submit the name if the name do not fall under the rules and regulations of Ministry.

Any individual person who is above the age of 18 can easily become the director of the company after procuring DIN number also known as Director Identification Number.

This a unique code for the Directors of a company for their exclusive identification. Every applicant who would like to become the designated partner of LLP must have a DIN (Director’s identification number). Application for DIN can be made online through Ministry of Corporate Affairs Website. There is no need for physical presence, the whole process is online.

Digital Signature Certificate are the token provided by the certified authorities in India. Any form filled for the company registration must be affix with the Digital signature certificate. Also Directors in India requires DSC for DIN application and the subscibers to MOA must have DSC for submitting e-forms for incorporation.

Every company has a specific limit or ceiling to issue shares to the shareholders, which has been determined by both SEBI & RBI. Within this limit a company can issue shares to it’s shareholders. This is called authorized capital. And the share capital or paid up share capital is the actual amount received from the shareholders for the shares allotted to them.

For LLP registration LLP agreement or Partnership deed is absolutely essential and LLP agreement shall state that partnership business shall be carried on at the under mentioned address, which shall also be its registered office.

The value of stamp paper on which the LLP agreement must be printed or stamp duty to be paid on the LLP agreement is dependent on the state of incorporation and amount of capital contribution from the partner. Yes Notarization is necessary.

If the LLP agreement consists of the specific clause for operating more than one business then a company or person can run multiple businesses under one LLP.

No, LLP cannot be incorporated for non-profit making organisations. LLP can be incorporated only for profit making organisations.

It totally depends upon documents submitted by the individual. Whereas, the normal time taken by the Income tax is 10-15 days to issue PAN/TAN.

Annual compliance represents the yearly obligation of a company for the ministry of corporate affairs (MCA) and registrar of companies. At the same time its worth mentioning that these compliance varies, based on company types. Yes, it is mandatory to meet annual compliance yearly to run a company successfully, even when the company has no transaction for the year.

Annual compliance for LLP is much easier and cheaper than a pvt ltd company. There are just three compliances per year.

a) Filing of annual return.

b) Filing of statement of the accounts or financial statements.

c) Filing of income tax returns.

5 major advantages of LLP over Pvt Ltd

By far LLP registration has the better advantages than the partnership firms register under partnership act 1932. It has the separate legal entity as well as the limited risk bearing of its partners as compared to partnership firm members. At the same time important to note that the financial liability of the partners of LLP is confined to the contribution of each partner towards the formation of LLP. LLP is governed at regulated by the Limited Liability Partnership Act 2008.

It’s an important question which needs to be answered before company registration decision.

- For the small and medium business owner Pvt Ltd company registration is widely popular. But it’s important to note that Limited Liability Partnership is especially for the group of entrepreneurs who has more than one partners and want to have a separate legal entity for their business.

- LLP as compared to Pvt Limited company registration enjoys tax advantages and lesser compliance.

- One of the major advantages of LLP is that it does not have any requirement for authorized capital. Pvt ltd Company required having minimum rs 1, 00,000 as authorized capital.

- Partners of LLP hold both the ownership and power to manage the company, but in case of Pvt ltd Company the management and ownership is completely different. In short we can conclude that for small and very small business owners LLP registration can be a well thought out process for them. But for the middle and big enterprises Pvt Ltd company registration is much more advantageous.

- If the entity is small but wants to obtain a separate legal entity, LLP is better. Legal maintenance cost is much lower than the Pvt Ltd company annual compliance. LLP has flexible transfer ability of share policy, and it also has the feature of perpetual succession. As the ownership and management controlled by the owner himself, decision making speed is much more higher compared to Pvt ltd company.

Check your firm name availability now at one click (absolutely free !!)